Tel :

Tel :

On December 18th, the news that Nippon Steel wanted to acquire American steel companies for $14.9 billion has attracted widespread attention in the steel industry. If the acquisition is successfully achieved, Nippon Steel's crude steel production is expected to surpass the world's top three, and its crude steel production capacity is one step closer to the company's strategic goal of producing 100 million tons annually. However, the large-scale transaction still requires regulatory approval, and Nippon Steel stated that it is expected to be officially completed in the second to third quarters of next year. Based on the current situation, the transaction is facing numerous obstacles, difficulties, and challenges.

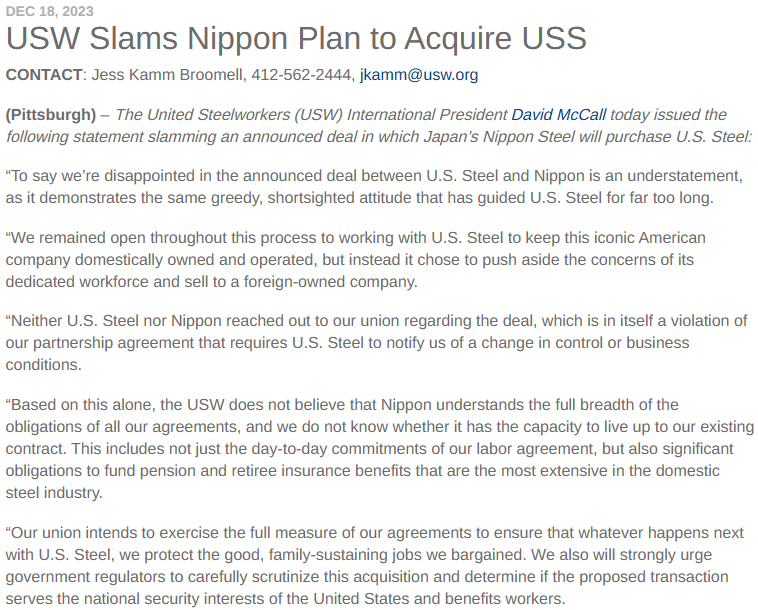

United Steelworkers of America (USW)

The biggest obstacle currently lies with the United Steelworkers of America (USW). On December 18th, on the day when Nippon Steel and American Steel announced a joint acquisition agreement, USW immediately issued a statement demanding that US regulatory agencies review the acquisition case and strongly oppose it on the grounds of harming the interests of steel workers and national security. As far as we know, the rapid response and sharp language used by USW this time are rare, and they have bluntly criticized the greed and shortsightedness of American JAC440W steel companies.

It is necessary to mention the status of USW in the United States. Its predecessor was the Steel Workers Organization Committee (SWOC) established in 1936. After decades of development, it is currently one of the most influential organizations in North America and the largest union in North America, with a total membership of over 1.2 million people (including Canada and the Caribbean region). The union organized multiple collective strikes after World War II, the largest of which involved 750000 steel workers. In the end, the JAC440W steel company compromised and increased worker wages, directly leading to an increase in domestic steel prices in the United States.

The total number of employees of American Steel Company reaches 65000, which is an important component of the USW membership system. At the same time, the company has a long history and largely represents the development history of the American steel industry. Therefore, the emotional acceptance of American Steel Company by Japanese controlled companies is not accepted by USW. Looking at it from a different perspective, if Japan Iron and Steel Corporation were to acquire a large state-owned steel plant in China, it is believed that it would also trigger unanimous opposition within the industry.

In addition, if Japanese capital enters strongly, USW's leadership of American steel company workers may also be compromised. Taking the automotive industry as an example, Japanese car giants such as Toyota, Honda, and Subaru entered the United States earlier. The United Association of Automobile Workers (UAW), which was equally strong as USW, had made efforts to incorporate Japanese car workers in the United States into unions. However, under the manipulation of Japanese companies, all efforts ended in failure. In September of this year, the collective strike of the three major car manufacturers (Ford, General Motors, and Stellantis) organized by UAW lasted for 6 weeks, involving 45000 people, and finally reached a temporary agreement, which includes a 25% increase in employee basic wages by April 2028. Under the influence of this incident, Japanese companies voluntarily raised worker salaries. Honda Motor announced that it will raise wages for its US workers by 11% starting from January next year. Toyota announced that starting next year, workers in the United States will receive a 9% salary increase and additional paid leave. It is not difficult to see that UAW's influence on foreign controlled non union car companies is far less than that of domestic car companies, so USW hopes that the large local steel plant Cleveland Cleves will acquire American steel companies.

US government departments

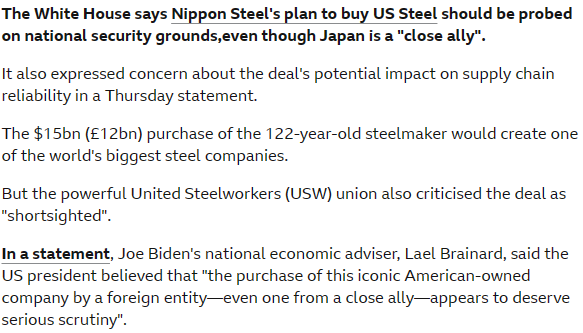

Shortly after the news of the acquisition by Nippon Steel, several US senators publicly expressed their opposition to the acquisition of American Steel, a historic steel plant, by a foreign company. The main factor is that they need to gain the support of American blue collar workers before next year's election, and opposing the acquisition has become a politically correct manifestation of the current situation. From the public statements of the US government on December 22nd, it appears that this acquisition case cannot bypass the security review mechanism, even if Japan is a close ally of the United States.

So, what is the probability that Japanese made iron will pass the relevant review by the United States? In recent years, the United States has maintained a relatively exclusive attitude towards steel products from Japan. In 2018, the United States moved out of Section 232 and imposed steel and aluminum tariffs on dozens of countries, citing a threat to national security (25% on imported steel and 10% on imported aluminum). Japan is also included in this list, and almost all steel and aluminum products exported to the United States are included. Finally, in 2022, after multiple rounds of negotiations, the United States set an annual duty-free quota of 1.25 million short tons for 54 types of steel products imported from Japan, which is basically the same as the quantity of steel products imported from Japan from 2018 to 2019. Products exceeding the import quota limit still need to pay a 25% tariff.

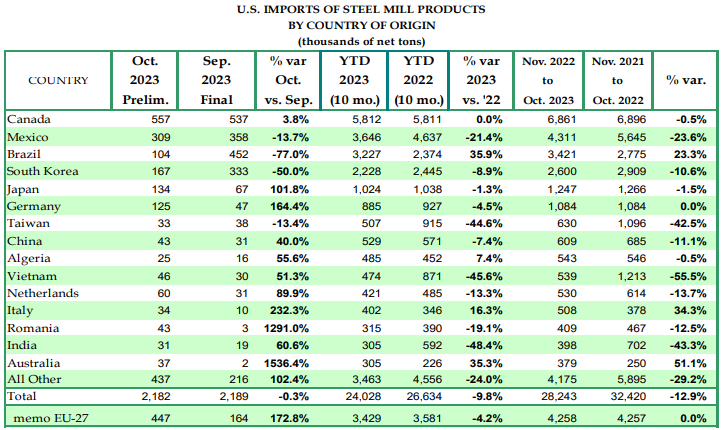

Based on actual data from 2023, Japan's total exports of steel products to the United States rank fifth. Although both are allies of the United States, the quantity of South Korean steel products exported to the United States is about 2.6 million short tons, which is about twice that of Japan. In reality, the US policy towards Japanese steel cannot be considered friendly. In addition, American Steel Company is also an important source of special steel for the US military, so the probability of this acquisition passing the relevant US security review mechanism is extremely low.

epilogue

Although Nippon Steel, as the world's fourth largest steel group, has net assets of only over $34 billion (2022 financial report), using bond financing to raise nearly $15 billion is likely to worsen Nippon Steel's financial situation. Even if the acquisition is successful, Nippon Steel will face huge financial difficulties. On the other hand, just as the merger news was announced, the stock price of American steel companies rose by 26.1% on the same day, reaching the highest level since April 2011. Although the path of mergers and acquisitions has been bumpy, regardless of the outcome, it has almost no negative impact on American steel companies. On the contrary, Japan Steel's $14.9 billion bid has given American steel companies an opportunity to raise their value JAC440W steel.